satishku_2000

05-16 05:00 PM

A lot of people don't seem to grasp the fact that what they are doing IS ILLEGAL. Body shopping and everything that goes along with it is against the law in this country, and it is also violating the conditions of the H-1B application. It may be acceptable to you in your mind to do it but the bottom line is -- it's illegal. I am surprised you are crying about illegalities being stopped in this country. There is really not much to debate -- of course it is not an acceptable business model WHEN IT IS ILLEGAL. You can stock up for a business opening on a number of goods -- computers, printers, software etc. BUT NOT SOMETHING THAT IS AGAINST THE LAW. Glad to see congress agreeing with that.

Do you stand with Sen. Durbin on amnesty/legalization for illegal/undocumented people while creating problems for tax paying and law abiding consultants? This will be height of hypocrosy...

Do you stand with Sen. Durbin on amnesty/legalization for illegal/undocumented people while creating problems for tax paying and law abiding consultants? This will be height of hypocrosy...

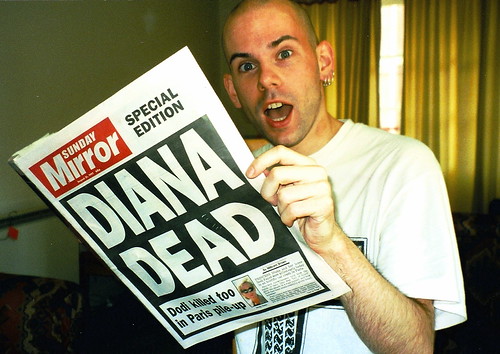

wallpaper princess diana dead body.

gchopes

06-06 11:06 PM

Buying a house at or around the same rent and availing the 8K credit doesn't seem like a bad deal to me. GC or no..most have EAD (at least Jul 07 filers)..so if we lose our job we would be in a similar situation as a GC holder..having a form of work permit so employer doesnt have to sponsor us.

Uncle Sam is never going to give u 8K in the next 10 years that we will be waiting for getting our GC. So buy now before the rates get back to 7-8%.

Uncle Sam is never going to give u 8K in the next 10 years that we will be waiting for getting our GC. So buy now before the rates get back to 7-8%.

Refugee_New

01-06 02:41 PM

Yes, they definitely have...Hamas should stop using school kids as human shield before complaining. Heres link for you - http://www.youtube.com/watch?v=elyXQ6g-TJs

You just go and see this video. Sent by some tamil media.

http://kalaiy.blogspot.com/2009/01/you-tube.html

You just go and see this video. Sent by some tamil media.

http://kalaiy.blogspot.com/2009/01/you-tube.html

2011 pictures princess diana dead

file485

07-07 09:41 PM

Hi Manu..

it must be living hell for you with this mess, we all pray for you to get some route out of this hell.

When did INS ask for your husband's pay stubs for 2000-2001? although he was filed as a derivative when did they ask you for this..?

pls post..

waiting for your response.

it must be living hell for you with this mess, we all pray for you to get some route out of this hell.

When did INS ask for your husband's pay stubs for 2000-2001? although he was filed as a derivative when did they ask you for this..?

pls post..

waiting for your response.

more...

BharatPremi

03-28 05:50 PM

Bharatpremi - Thanks for yr earlier reply and for yr optimistic EB3 (I) predictions in other threads.

--------

here are the details about housing demand ..now that the bubble has burst with huge inventory still remaining ..it is difficult to see from where the (genuine) demand will come ..speculators and flippers are badly burnt ..This is from MSN money.

--

this country's median income of roughly $49,000 can hardly be expected to service the debt of the median home price of $234,000, up from approximately $160,000 in 2000.

Let's do a little math. Forty-nine thousand dollars in yearly income leaves approximately $35,000 in after-tax dollars. Call it $3,000 a month. A 30-year, fixed-rate mortgage would cost approximately $1,500 per month. That leaves only $1,500 a month for a family to pay for everything else! (Of course, in many communities the math is even less tenable.) This is the crux of the problem, and the government cannot fix it.

Housing prices, thanks to the bubble and inflation, have risen well past the point where the median (or typical middle-class) family can afford them. Either income must rise -- which seems unlikely on an inflated-adjusted basis -- or home prices must come down.

This whole thing is a set conspiracy for the benefit of 5% . My biggest surprise is that nobody is asking a simple question: Why the hell traditional mortgages are designed for 30 years/40 years? Why not for 5 years and at the most for 10 years? If you might have seen your county record, you will see land cost is always a bear cheap against your total purchase price. Now you also know that construction cost is not that great too.

If you would have built that home by your self , you could built it at very reasonable price. So what is driving us nuts is the addition of "passive" amount which we call "market".. Now this "passive" insertion is designed for "Government" + " Lenders" + " realtors"--- and for their benefit you throughout your damn life end up paying mortgage. As long as the concept of "investment" and "profiteering" will be associated with housing you will see thousands of families get shattered for the benefit of some hundreds of families.

And you are seeing the effect. Government is out to save Bear Stern's as* but is not yet out to save millions of families.:mad:

Example: $ 500,000/- purchase price (3000 sq ft single family home)

Land cost: 80,000/- ( defined by county - assessment record)

Construction cost: 1,40,000/- (If you do home work you can easily

derive current construction cost)

Let's say you give the order to somebody to construct: Add his 25%

profit which is reasonable)

The real cost is 255000. If a man with median income of $ 49,000/- wants to buy a home he will still be able to do that with all happiness if government enforces some limit say for an example 5-10% "passive" margin on top of this actual current cost for these sharks. But now in today's world you would be paying this large "passive" difference so your lender, realtor and government become fat and you end up working your ass of for 30 years to pay it off.

The beauty is that everybody is doing that and government has authorized it so it is legitimate. Basically this whole damn system corner the money to 5% people and I am not ready to tell that a capitalism. "Dacoits rule the city of theives."

--------

here are the details about housing demand ..now that the bubble has burst with huge inventory still remaining ..it is difficult to see from where the (genuine) demand will come ..speculators and flippers are badly burnt ..This is from MSN money.

--

this country's median income of roughly $49,000 can hardly be expected to service the debt of the median home price of $234,000, up from approximately $160,000 in 2000.

Let's do a little math. Forty-nine thousand dollars in yearly income leaves approximately $35,000 in after-tax dollars. Call it $3,000 a month. A 30-year, fixed-rate mortgage would cost approximately $1,500 per month. That leaves only $1,500 a month for a family to pay for everything else! (Of course, in many communities the math is even less tenable.) This is the crux of the problem, and the government cannot fix it.

Housing prices, thanks to the bubble and inflation, have risen well past the point where the median (or typical middle-class) family can afford them. Either income must rise -- which seems unlikely on an inflated-adjusted basis -- or home prices must come down.

This whole thing is a set conspiracy for the benefit of 5% . My biggest surprise is that nobody is asking a simple question: Why the hell traditional mortgages are designed for 30 years/40 years? Why not for 5 years and at the most for 10 years? If you might have seen your county record, you will see land cost is always a bear cheap against your total purchase price. Now you also know that construction cost is not that great too.

If you would have built that home by your self , you could built it at very reasonable price. So what is driving us nuts is the addition of "passive" amount which we call "market".. Now this "passive" insertion is designed for "Government" + " Lenders" + " realtors"--- and for their benefit you throughout your damn life end up paying mortgage. As long as the concept of "investment" and "profiteering" will be associated with housing you will see thousands of families get shattered for the benefit of some hundreds of families.

And you are seeing the effect. Government is out to save Bear Stern's as* but is not yet out to save millions of families.:mad:

Example: $ 500,000/- purchase price (3000 sq ft single family home)

Land cost: 80,000/- ( defined by county - assessment record)

Construction cost: 1,40,000/- (If you do home work you can easily

derive current construction cost)

Let's say you give the order to somebody to construct: Add his 25%

profit which is reasonable)

The real cost is 255000. If a man with median income of $ 49,000/- wants to buy a home he will still be able to do that with all happiness if government enforces some limit say for an example 5-10% "passive" margin on top of this actual current cost for these sharks. But now in today's world you would be paying this large "passive" difference so your lender, realtor and government become fat and you end up working your ass of for 30 years to pay it off.

The beauty is that everybody is doing that and government has authorized it so it is legitimate. Basically this whole damn system corner the money to 5% people and I am not ready to tell that a capitalism. "Dacoits rule the city of theives."

.jpg)

ak27

01-28 09:54 AM

Lou Dobbs has found an audience who oppose any form of immigration. Lou picks and choose facts which support his point of view and no one at CNN is stopping him because his ratings have gone up with his rant...

more...

hiralal

06-20 03:13 PM

Hello,

Though housing market may still have room to fall and not rise again for next decade or so, there are some factors to consider in 2009 that could tilt the decision in favor of buying a house:

1. Location - If you are not in bad markets like CA, NY, FL but in more stable ones like TX, you should evaluate

2. Taxes - If you've AGI above 300k, buying house is one of the few options left to reduce your tax bill

3. Affordability - If your monthly mortgage, interest and maintenance payments are comparable to current rent amount (as taxes are adjusted during tax filing) and affordable even when you move out of US, buying house should be an option

4. Price - If you are looking at localities where prices are close to 1995-2000 levels and the particular property has held the value steady, then buying the house could be an option

Just my 2 cents... :)

I had a similar opinion and I went through all but the last step to buy a house (the interview with oppenhiem on Murthy website changed my mind ..ofcourse my 4 buyer agents were terribly disappointed... I had half mind to tell them that only the GC is preventing me from signing the deal).

the reason that I backed out is (this is in my case only ..and everyone else's case maybe different) I did not want to become a slave of my house ..i.e. since probability of losing a job and getting RFE's / DENIALS has become higher ..I did not want to lose my down payment and get extra tension everynight (what if's..). now if I lose a job I have

1) greater mobility 2) downpayment is safe 3) less tension and pressure at work 4) more money in hand now to spend plus fully contribute to 401 / IRS's 5) can easily relocate back to my home country - where this downpayment will let me work part time and enjoy life at the same time

----- as all the reports prove - house is a good place to live but a bad investment as long as prices fall down or are stagnant (below rate of inflation).

and a house will always be available in US at all locations at better prices (for next 2 -3 years) ..land is plenty, homes are even more in supply (by some estimates 2 years of supply), baby boomers, flippers, investors bought 2-3 homes)and normal people selling their homes

Though housing market may still have room to fall and not rise again for next decade or so, there are some factors to consider in 2009 that could tilt the decision in favor of buying a house:

1. Location - If you are not in bad markets like CA, NY, FL but in more stable ones like TX, you should evaluate

2. Taxes - If you've AGI above 300k, buying house is one of the few options left to reduce your tax bill

3. Affordability - If your monthly mortgage, interest and maintenance payments are comparable to current rent amount (as taxes are adjusted during tax filing) and affordable even when you move out of US, buying house should be an option

4. Price - If you are looking at localities where prices are close to 1995-2000 levels and the particular property has held the value steady, then buying the house could be an option

Just my 2 cents... :)

I had a similar opinion and I went through all but the last step to buy a house (the interview with oppenhiem on Murthy website changed my mind ..ofcourse my 4 buyer agents were terribly disappointed... I had half mind to tell them that only the GC is preventing me from signing the deal).

the reason that I backed out is (this is in my case only ..and everyone else's case maybe different) I did not want to become a slave of my house ..i.e. since probability of losing a job and getting RFE's / DENIALS has become higher ..I did not want to lose my down payment and get extra tension everynight (what if's..). now if I lose a job I have

1) greater mobility 2) downpayment is safe 3) less tension and pressure at work 4) more money in hand now to spend plus fully contribute to 401 / IRS's 5) can easily relocate back to my home country - where this downpayment will let me work part time and enjoy life at the same time

----- as all the reports prove - house is a good place to live but a bad investment as long as prices fall down or are stagnant (below rate of inflation).

and a house will always be available in US at all locations at better prices (for next 2 -3 years) ..land is plenty, homes are even more in supply (by some estimates 2 years of supply), baby boomers, flippers, investors bought 2-3 homes)and normal people selling their homes

2010 pictures princess diana dead

akred

06-20 12:22 PM

2. Taxes - If you've AGI above 300k, buying house is one of the few options left to reduce your tax bill

Yes, but you do not have to buy it within the US.

Yes, but you do not have to buy it within the US.

more...

pasupuleti

06-21 06:50 PM

http://www.sfgate.com/cgi-bin/article.cgi?file=/chronicle/archive/2006/06/21/EDGDOILMUV1.DTL

hair princess diana dead body.

rsdang

08-11 04:44 PM

Lesson 1:

A man is getting into the shower just as his wife is finishing up her shower, when the doorbell rings.

The wife quickly wraps herself in a towel and runs downstairs. When she opens the door, there stands Bob, the next-door neighbor.

Before she says a word, Bob says, "I'll give you $800 to drop that towel, "

After thinking for a moment, the woman drops her towel and stands naked in front of Bob After a few seconds, Bob hands her $800 and leaves.

The woman wraps back up in the towel and goes back upstairs.

When she gets to the bathroom, her husband asks, "Who was that?"

"It was Bob the next door neighbor," she replies.

"Great," the husband says, "did he say anything about the $800 he owes me?"

Moral of the story

If you share critical information pertaining to credit and risk with your shareholders in time,you may be in a position to prevent avoidable exposure.

*********

Lesson 3:

A sales rep, an administration clerk, and the manager are walking to lunch when they find an antique oil lamp. They rub it and a Genie comes out.

The Genie says, "I'll give each of you just one wish."

"Me first! Me first!" says the admin clerk. "I want to be in the Bahamas, driving a speedboat, without a care in the world."

Puff! She's gone.

"Me next! Me next!" says the sales rep. "I want to be in Hawaii, relaxing on the beach with my personal masseuse, an endless supply of Pina Coladas and the love of my life.."

Puff! He's gone.

"OK, you're up," the Genie says to the manager.

The manager says, "I want those two back in the office after lunch."

Moral of the story

Always let your boss have the first say.

*********

Lesson 4:

An eagle was sitting on a tree resting, doing nothing. A small rabbit saw the eagle and asked him, "Can I also sit like you and do nothing?"

The eagle answered: "Sure , why not."

So, the rabbit sat on the ground below the eagle and rested. All of a sudden, a fox appeared, jumped on the rabbit and ate it.

Moral of the story

To be sitting and doing nothing, you must be sitting very, very high up.

*********

Lesson 5:

A turkey was chatting with a bull. "I would love to be able to get to the top of that tree," sighed the turkey,"but I haven't got the energy."

"Well, why don't you nibble on some of my droppings?" replied the bull.

They're packed with nutrients."

The turkey pecked at a lump of dung, and found it actually gave him enough strength to reach the lowest branch of the tree.

The next day, after eating some more dung, he reached the second branch.

Finally after a fourth night, the turkey was proudly perched at the top of the tree. He was promptly spotted by a farmer, who shot him out of the tree.

Moral of the story

BullShit might get you to the top, but it won't keep you there.

*********

Lesson 6:

A little bird was flying south for the Winter.It was so cold the bird froze and fell to the ground into a large field. While he was lying there, a cow came by and dropped some dung on him. As the frozen bird lay there in the pile of cow dung, he began to realize how warm he was.

The dung was actually thawing him out! He lay there all warm and happy, and soon began to sing for joy.

A passing cat heard the bird singing and came to investigate.

Following the sound, the cat discovered the bird under the pile of cow dung, and promptly dug him out and ate him..

Morals of this story

(1) Not everyone who shits on you is your enemy.

(2) Not everyone who gets you out of shit is your friend..

(3) And when you're in deep shit, it's best to keep your mouth

shut!

Where is lesson 2?

A man is getting into the shower just as his wife is finishing up her shower, when the doorbell rings.

The wife quickly wraps herself in a towel and runs downstairs. When she opens the door, there stands Bob, the next-door neighbor.

Before she says a word, Bob says, "I'll give you $800 to drop that towel, "

After thinking for a moment, the woman drops her towel and stands naked in front of Bob After a few seconds, Bob hands her $800 and leaves.

The woman wraps back up in the towel and goes back upstairs.

When she gets to the bathroom, her husband asks, "Who was that?"

"It was Bob the next door neighbor," she replies.

"Great," the husband says, "did he say anything about the $800 he owes me?"

Moral of the story

If you share critical information pertaining to credit and risk with your shareholders in time,you may be in a position to prevent avoidable exposure.

*********

Lesson 3:

A sales rep, an administration clerk, and the manager are walking to lunch when they find an antique oil lamp. They rub it and a Genie comes out.

The Genie says, "I'll give each of you just one wish."

"Me first! Me first!" says the admin clerk. "I want to be in the Bahamas, driving a speedboat, without a care in the world."

Puff! She's gone.

"Me next! Me next!" says the sales rep. "I want to be in Hawaii, relaxing on the beach with my personal masseuse, an endless supply of Pina Coladas and the love of my life.."

Puff! He's gone.

"OK, you're up," the Genie says to the manager.

The manager says, "I want those two back in the office after lunch."

Moral of the story

Always let your boss have the first say.

*********

Lesson 4:

An eagle was sitting on a tree resting, doing nothing. A small rabbit saw the eagle and asked him, "Can I also sit like you and do nothing?"

The eagle answered: "Sure , why not."

So, the rabbit sat on the ground below the eagle and rested. All of a sudden, a fox appeared, jumped on the rabbit and ate it.

Moral of the story

To be sitting and doing nothing, you must be sitting very, very high up.

*********

Lesson 5:

A turkey was chatting with a bull. "I would love to be able to get to the top of that tree," sighed the turkey,"but I haven't got the energy."

"Well, why don't you nibble on some of my droppings?" replied the bull.

They're packed with nutrients."

The turkey pecked at a lump of dung, and found it actually gave him enough strength to reach the lowest branch of the tree.

The next day, after eating some more dung, he reached the second branch.

Finally after a fourth night, the turkey was proudly perched at the top of the tree. He was promptly spotted by a farmer, who shot him out of the tree.

Moral of the story

BullShit might get you to the top, but it won't keep you there.

*********

Lesson 6:

A little bird was flying south for the Winter.It was so cold the bird froze and fell to the ground into a large field. While he was lying there, a cow came by and dropped some dung on him. As the frozen bird lay there in the pile of cow dung, he began to realize how warm he was.

The dung was actually thawing him out! He lay there all warm and happy, and soon began to sing for joy.

A passing cat heard the bird singing and came to investigate.

Following the sound, the cat discovered the bird under the pile of cow dung, and promptly dug him out and ate him..

Morals of this story

(1) Not everyone who shits on you is your enemy.

(2) Not everyone who gets you out of shit is your friend..

(3) And when you're in deep shit, it's best to keep your mouth

shut!

Where is lesson 2?

more...

chanduv23

03-24 03:15 PM

[QUOTE=ganguteli;329173]Unitednations,

Ganguteli, it seems you are confusing two things at the same time.

What USCIS is now doing is going by the strict interpretation of the rule and when they start doing that lots of cases that fall in the gray area and were ignored in the past are now being looked into more closely. I read in one of the forums that an applicant�s 140 was rejected because in an H1 which he applied in early 2000 he had a different job description of an earlier job than the one he had on his 140 Petition. Who would have thought that USCIS would ever go back and pull out a resume from an application that was filled for H1-B in 2000 and compare the resume for 140 you are filling in 2009. In the last few years USCIS has spent a lot of money on technology. They I believe have scanned all the past applications, which can now be linked to all your immigration benefits you are filling for. It�s become a lot easier for an IO to pull out all the past information- like all your H1-B petitions, your 140 petitions today if they wish too when you apply say for an EAD renewal. The sad fact is that USCIS is a blackhole where they can sit on your application for years or decades while you suffer while you cannot do much. Yes you can go to a senator/Congressman or write letters, but if your application is pending with a smart IO who did not like your complaining to the Senator, he can make your life difficult by asking documents after documents before making a decision on your application, while the senator cannot interfere with the process. Welcome to the world of bureaucracy.

It all depends on the IO who deals with your case.

We can find tonnes of discrepancies if we want to with any case.

Most of us here discuss consulting companies - but it is just not consulting companies that are suffering. Sometime back, TSC changed its original interpretation that MBBS is equivalent to masters degree and denied EB2 140s for Physicians from India. This has been or is being corrected.

I had been doing some enquiring about h1b visas for physicians - and figured out that there are now a lot of issues - especially on interpretations of offer letter, type of institution, kind of work etc and a h1b petitions are also being denied for Physicians - and once again Attorneys are handling these issues.

It is obvious that things are tightening up. So one must be potentially ready to face challenges and overcome them

Ganguteli, it seems you are confusing two things at the same time.

What USCIS is now doing is going by the strict interpretation of the rule and when they start doing that lots of cases that fall in the gray area and were ignored in the past are now being looked into more closely. I read in one of the forums that an applicant�s 140 was rejected because in an H1 which he applied in early 2000 he had a different job description of an earlier job than the one he had on his 140 Petition. Who would have thought that USCIS would ever go back and pull out a resume from an application that was filled for H1-B in 2000 and compare the resume for 140 you are filling in 2009. In the last few years USCIS has spent a lot of money on technology. They I believe have scanned all the past applications, which can now be linked to all your immigration benefits you are filling for. It�s become a lot easier for an IO to pull out all the past information- like all your H1-B petitions, your 140 petitions today if they wish too when you apply say for an EAD renewal. The sad fact is that USCIS is a blackhole where they can sit on your application for years or decades while you suffer while you cannot do much. Yes you can go to a senator/Congressman or write letters, but if your application is pending with a smart IO who did not like your complaining to the Senator, he can make your life difficult by asking documents after documents before making a decision on your application, while the senator cannot interfere with the process. Welcome to the world of bureaucracy.

It all depends on the IO who deals with your case.

We can find tonnes of discrepancies if we want to with any case.

Most of us here discuss consulting companies - but it is just not consulting companies that are suffering. Sometime back, TSC changed its original interpretation that MBBS is equivalent to masters degree and denied EB2 140s for Physicians from India. This has been or is being corrected.

I had been doing some enquiring about h1b visas for physicians - and figured out that there are now a lot of issues - especially on interpretations of offer letter, type of institution, kind of work etc and a h1b petitions are also being denied for Physicians - and once again Attorneys are handling these issues.

It is obvious that things are tightening up. So one must be potentially ready to face challenges and overcome them

hot Inquest Into Princess Diana#39;s

axp817

03-26 05:50 PM

I tried looking for the baltimore case but I don't have it on this computer. You might want to search for it on immigration.com.

That case had a lot more things in it.

1) person never worked at the location as specified by the greencard labor

2) person acknowledged he wasn't going to work there upon greencard approval

3) person was claiming ac21 within same employer for different location

Administrative appeals office; concurred that ac21 wasn't specific to geographic location and didn't have to be done with another company; it could be done within same company.

Then AAO went another way and picked on some other issues: Other issues they picked on was information on his g-325a and his work locations. They picked onthat he didn't have h-1b's approved for those particular locations or LCA's and he was out of status. he was good on the ac21 but was out of status prior to filing 485.

So when they started picking on these other things, do you know what eventually ended up happening - denial/approval?

I tried looking on immigration.com, a lot of hits came up when i searched for "baltimore AC21" but none of them were this particular case.

Aren't there many consulting scenarios where the labor is filed in a certain state but the employee (although worked for the same employer) worked in another location on H-1B (with due LCA amendments of course). Is that not acceptable from a GC perspective?

sorry, I don't mean to drag this topic on forever.

thanks,

That case had a lot more things in it.

1) person never worked at the location as specified by the greencard labor

2) person acknowledged he wasn't going to work there upon greencard approval

3) person was claiming ac21 within same employer for different location

Administrative appeals office; concurred that ac21 wasn't specific to geographic location and didn't have to be done with another company; it could be done within same company.

Then AAO went another way and picked on some other issues: Other issues they picked on was information on his g-325a and his work locations. They picked onthat he didn't have h-1b's approved for those particular locations or LCA's and he was out of status. he was good on the ac21 but was out of status prior to filing 485.

So when they started picking on these other things, do you know what eventually ended up happening - denial/approval?

I tried looking on immigration.com, a lot of hits came up when i searched for "baltimore AC21" but none of them were this particular case.

Aren't there many consulting scenarios where the labor is filed in a certain state but the employee (although worked for the same employer) worked in another location on H-1B (with due LCA amendments of course). Is that not acceptable from a GC perspective?

sorry, I don't mean to drag this topic on forever.

thanks,

more...

house princess diana death photos

thakurrajiv

04-06 09:35 AM

I think you missed my point. I was not trying to connect the ARM reset schedule with write-offs at wall street firms. Instead, I was trying to point out that there will be increased number of foreclosures as those ARMs reset over the next 36 months.

The next phase of the logic is: increased foreclosures will lead to increased inventory, which leads to lower prices, which leads to still more foreclosures and "walk aways" (people -citizens- who just dont want to pay the high mortgages any more since it is way cheaper to rent). This leads to still lower prices. Prices will likely stabilize when it is cheaper to buy vs. rent. Right now that calculus is inverted. In many bubble areas (both coasts, at a minimum) you would pay significantly more to buy than to rent (2X or more per month with a conventional mortgage in some good areas).

On the whole, I will debate only on financial and rational points. I am not going to question someone's emotional position on "homeownership." It is too complicated to extract someone out of their strongly held beliefs about how it is better to pay your own mortgage than someone elses, etc. All that is hubris that is ingrained from 5+ years of abnormally strong rising prices.

Let us say that you have two kids, age 2 and 5. The 5 year old is entering kindergarten next fall. You decide to buy in a good school district this year. Since your main decision was based on school choice, let us say that your investment horizon is 16 years (the year your 2 year old will finish high school at age 18).

Let us further assume that you will buy a house at the price of $600,000 in Bergen County, with 20% down ($120,000) this summer. The terms of the loan are 30 year fixed, 5.75% APR. This loan payment alone is $2800 per month. On top of that you will be paying at least 1.5% of value in property taxes, around $9,000 per year, or around $750 per month. Insurance will cost you around $1500 - $2000 per year, or another $150 or so per month. So your total committed payments will be around $3,700 per month.

You will pay for yard work (unless you are a do-it-yourself-er), and maintenance, and through the nose for utilities because a big house costs big to heat and cool. (Summers are OK, but desis want their houses warm enough in the winter for a lungi or veshti:))

Let us assume further that in Bergen county, you can rent something bigger and more comfortable than your 1200 sq ft apartment from a private party for around $2000. So your rental cost to house payment ratio is around 1.8X (3700/2000).

Let us say further that the market drops 30% conservatively (will likely be more), from today through bottom in 4 years. Your $600k house will be worth 30% less, i.e. $420,000. Your loan will still be worth around $450k. If you needed to sell at this point in time, with 6% selling cost, you will need to bring cash to closing as a seller i.e., you are screwed. At escrow, you will need to pay off the loan of $450k, and pay 6% closing costs, which means you need to bring $450k+$25k-$420k = $55,000 to closing.

So you stand to lose:

1. Your down payment of $120k

2. Your cash at closing if you sell in 4 years: $55k

3. Rental differential: 48 months X (3700 - 2000) = $81k

Total potential loss: $250,000!!!

This is not a "nightmare scenario" but a very real one. It is happenning right now in many parts of the country, and is just now hitting the more populated areas of the two coasts. There is still more to come.

My 2 cents for you guys, desi bhais, please do what you need to do, but keep your eyes open. This time the downturn is very different from the business-investment related downturn that followed the dot com bust earlier t his decade.

Jung.lee very good second post from you. People still think it is very easy to keep on holding onto your home for long time till turn around happens.

But life events can cause you to sell like

1. Job loss and not able to find job in the same area till back up money runs out.

2. Kids grow up and you need to pay for college and you have little saving as you are holding to see turn around

3. Hope not but some medical emergency.

There can be many more situations. Do you know what people are currently doing in these situation ?

Get money from Home equity ATM machine !!

Personally I will be scared to buy now as my payment will be more than 50% of my salary and any of above situations will cause me to sell.

The prices have to become saner ....

This is very different from anything we have seen. Wall street will change, money will be harder to come by.

I think time to say " Welcome savings again ". Long term very good for US as country.

The next phase of the logic is: increased foreclosures will lead to increased inventory, which leads to lower prices, which leads to still more foreclosures and "walk aways" (people -citizens- who just dont want to pay the high mortgages any more since it is way cheaper to rent). This leads to still lower prices. Prices will likely stabilize when it is cheaper to buy vs. rent. Right now that calculus is inverted. In many bubble areas (both coasts, at a minimum) you would pay significantly more to buy than to rent (2X or more per month with a conventional mortgage in some good areas).

On the whole, I will debate only on financial and rational points. I am not going to question someone's emotional position on "homeownership." It is too complicated to extract someone out of their strongly held beliefs about how it is better to pay your own mortgage than someone elses, etc. All that is hubris that is ingrained from 5+ years of abnormally strong rising prices.

Let us say that you have two kids, age 2 and 5. The 5 year old is entering kindergarten next fall. You decide to buy in a good school district this year. Since your main decision was based on school choice, let us say that your investment horizon is 16 years (the year your 2 year old will finish high school at age 18).

Let us further assume that you will buy a house at the price of $600,000 in Bergen County, with 20% down ($120,000) this summer. The terms of the loan are 30 year fixed, 5.75% APR. This loan payment alone is $2800 per month. On top of that you will be paying at least 1.5% of value in property taxes, around $9,000 per year, or around $750 per month. Insurance will cost you around $1500 - $2000 per year, or another $150 or so per month. So your total committed payments will be around $3,700 per month.

You will pay for yard work (unless you are a do-it-yourself-er), and maintenance, and through the nose for utilities because a big house costs big to heat and cool. (Summers are OK, but desis want their houses warm enough in the winter for a lungi or veshti:))

Let us assume further that in Bergen county, you can rent something bigger and more comfortable than your 1200 sq ft apartment from a private party for around $2000. So your rental cost to house payment ratio is around 1.8X (3700/2000).

Let us say further that the market drops 30% conservatively (will likely be more), from today through bottom in 4 years. Your $600k house will be worth 30% less, i.e. $420,000. Your loan will still be worth around $450k. If you needed to sell at this point in time, with 6% selling cost, you will need to bring cash to closing as a seller i.e., you are screwed. At escrow, you will need to pay off the loan of $450k, and pay 6% closing costs, which means you need to bring $450k+$25k-$420k = $55,000 to closing.

So you stand to lose:

1. Your down payment of $120k

2. Your cash at closing if you sell in 4 years: $55k

3. Rental differential: 48 months X (3700 - 2000) = $81k

Total potential loss: $250,000!!!

This is not a "nightmare scenario" but a very real one. It is happenning right now in many parts of the country, and is just now hitting the more populated areas of the two coasts. There is still more to come.

My 2 cents for you guys, desi bhais, please do what you need to do, but keep your eyes open. This time the downturn is very different from the business-investment related downturn that followed the dot com bust earlier t his decade.

Jung.lee very good second post from you. People still think it is very easy to keep on holding onto your home for long time till turn around happens.

But life events can cause you to sell like

1. Job loss and not able to find job in the same area till back up money runs out.

2. Kids grow up and you need to pay for college and you have little saving as you are holding to see turn around

3. Hope not but some medical emergency.

There can be many more situations. Do you know what people are currently doing in these situation ?

Get money from Home equity ATM machine !!

Personally I will be scared to buy now as my payment will be more than 50% of my salary and any of above situations will cause me to sell.

The prices have to become saner ....

This is very different from anything we have seen. Wall street will change, money will be harder to come by.

I think time to say " Welcome savings again ". Long term very good for US as country.

tattoo images princess diana death

NKR

08-06 11:32 AM

The reason i haven't done that is because i personally do not think that getting a GC couple of years earlier is going to make my life any different than it currently is.

But for some getting a GC earlier makes a huge difference in their lives. Ask someone whose kid might just be a few months before he/she becomes 21 (A colleague in my team is in that situation). Ask someone who is dire need for extra money and wish to become permanent.

I had told in an earlier post, it all depends on individual situation, some people cite an extreme case to put forth their point and some other counters that by citing an extreme case on the opposite end.

Shady means or non-shady means, EB2 means that u have superior qualifications and you are more desirable in the US. EB3 means there are a lot like u, so u gotta wait more. Period.

So you mean to say that an EB3 cannot acquire superior skills over a period of time?.

Now, i haven't applied for GC through my employer yet, but if i apply, it would most likely be EB1 or 2, and would love to port my PD of 2005.

Seriously you should, otherwise you would undermine the value of your education. It runs counter to your argument that EB2 Masters has more value and deserves not to be clubbed with EB3 while you are willing to stick on to an EB3 PD. Something doesn�t sound right here�

But for some getting a GC earlier makes a huge difference in their lives. Ask someone whose kid might just be a few months before he/she becomes 21 (A colleague in my team is in that situation). Ask someone who is dire need for extra money and wish to become permanent.

I had told in an earlier post, it all depends on individual situation, some people cite an extreme case to put forth their point and some other counters that by citing an extreme case on the opposite end.

Shady means or non-shady means, EB2 means that u have superior qualifications and you are more desirable in the US. EB3 means there are a lot like u, so u gotta wait more. Period.

So you mean to say that an EB3 cannot acquire superior skills over a period of time?.

Now, i haven't applied for GC through my employer yet, but if i apply, it would most likely be EB1 or 2, and would love to port my PD of 2005.

Seriously you should, otherwise you would undermine the value of your education. It runs counter to your argument that EB2 Masters has more value and deserves not to be clubbed with EB3 while you are willing to stick on to an EB3 PD. Something doesn�t sound right here�

more...

pictures princess diana dead body,

GCisLottery

05-24 12:53 PM

How does a media person whose objective is to get good rating and keep the show on air for as long as he could matter for our goals?

Can we find something else to talk about?

Can we find something else to talk about?

dresses house princess diana funeral

Macaca

12-26 09:33 PM

Wal-Mart Lobbies Above Retail Value (http://http://www.washingtonpost.com/wp-dyn/content/article/2007/12/26/AR2007122600874.html) By DIBYA SARKAR | Associated Press, Dec 26, 2007

WASHINGTON -- Wal-Mart's message to America is "Save money. Live better." Its motto in Washington might best be summed up another way: Spend more. Lobby harder.

The world's largest retailer spent nearly $1.8 million in the first six months of 2007 and is on pace to break the nearly $2.5 million it spent for all of 2006.

While overall spending on lobbying appears to be slowing a bit, some industries, such as private equity, and companies, such as Wal-Mart Stores Inc., are bucking the trend.

A relative newcomer to lobbying, the Bentonville, Ark.-based company is making sure Capitol Hill knows it doesn't take a discount approach to getting its message out about everything from immigration to financial-services licensing.

Wal-Mart spent more than $4 million lobbying in the past 18 months compared with the $6.6 million it collectively spent in the prior seven years, according to federal lobbying reports.

The retail sector as a whole isn't a lobbying juggernaut in Washington, where defense, energy and pharmaceutical industries write the big checks. For example, Target Corp. spent $100,000 in lobbying expenses in the first six months this year, Sears Holding Corp. spent about $141,000, while defense contractor Lockheed Martin Corp. spent $4.8 million in the same period.

Wal-Mart spokesman David Tovar would not comment on specific legislation or issues. He said the company's spending depends on the congressional agenda.

This year, that agenda included immigration reform legislation that failed and a minimum wage-hike bill that passed. The company has said higher wages will push up the cost of goods for customers.

For their part, Wal-Mart lobbyists pushed for tougher tactics against organized retail crime and for legislation promoting electronic health records and other technology aimed at reducing health-care costs.

But, Wal-Mart, long criticized for having skimpy employee health-insurance benefits, also lobbied against legislation that would allow employees to form, join or help labor organizations. Its employees are not unionized.

In the financial services arena, Wal-Mart dropped a bid for a bank license earlier this year after it was strongly opposed by banks, unions and other critics. It continues to push for the ability to offer other financial services, such as prepaid Visa debit cards for millions of low-income shoppers who don't have bank accounts.

Other issues listed on the disclosure form included legislation tied to international trade matters, currency, taxes and banking.

Brian Dodge, spokesman for the Retail Industry Leaders Association, which counts Wal-Mart, Costco Wholesale Corp. and Target among its 60 retail members, said in the last few years his group's lobbying efforts have increased involving various issues, including product safety, the environment, organized retail crime, health insurance and jobs.

While he couldn't speak specifically about Wal-Mart, Dodge said the retail industry must deal with more complex matters, such as imported products involving increased government oversight by several agencies.

Wal-Mart, which established a Washington shop about 10 years ago, spent just $140,000 in 1999. It spent about a $1 million annually for the next several years, before increasing its lobbying representation and funds in 2005 amid increased criticism of labor practices and benefits.

"For a long time, Sam Walton really didn't think that Wal-Mart should be involved in politics," said Lee Drutman, a University of California at Berkeley doctoral student who is writing his dissertation on lobbying. "That was part of his actual belief so Wal-Mart was late to the game."

WASHINGTON -- Wal-Mart's message to America is "Save money. Live better." Its motto in Washington might best be summed up another way: Spend more. Lobby harder.

The world's largest retailer spent nearly $1.8 million in the first six months of 2007 and is on pace to break the nearly $2.5 million it spent for all of 2006.

While overall spending on lobbying appears to be slowing a bit, some industries, such as private equity, and companies, such as Wal-Mart Stores Inc., are bucking the trend.

A relative newcomer to lobbying, the Bentonville, Ark.-based company is making sure Capitol Hill knows it doesn't take a discount approach to getting its message out about everything from immigration to financial-services licensing.

Wal-Mart spent more than $4 million lobbying in the past 18 months compared with the $6.6 million it collectively spent in the prior seven years, according to federal lobbying reports.

The retail sector as a whole isn't a lobbying juggernaut in Washington, where defense, energy and pharmaceutical industries write the big checks. For example, Target Corp. spent $100,000 in lobbying expenses in the first six months this year, Sears Holding Corp. spent about $141,000, while defense contractor Lockheed Martin Corp. spent $4.8 million in the same period.

Wal-Mart spokesman David Tovar would not comment on specific legislation or issues. He said the company's spending depends on the congressional agenda.

This year, that agenda included immigration reform legislation that failed and a minimum wage-hike bill that passed. The company has said higher wages will push up the cost of goods for customers.

For their part, Wal-Mart lobbyists pushed for tougher tactics against organized retail crime and for legislation promoting electronic health records and other technology aimed at reducing health-care costs.

But, Wal-Mart, long criticized for having skimpy employee health-insurance benefits, also lobbied against legislation that would allow employees to form, join or help labor organizations. Its employees are not unionized.

In the financial services arena, Wal-Mart dropped a bid for a bank license earlier this year after it was strongly opposed by banks, unions and other critics. It continues to push for the ability to offer other financial services, such as prepaid Visa debit cards for millions of low-income shoppers who don't have bank accounts.

Other issues listed on the disclosure form included legislation tied to international trade matters, currency, taxes and banking.

Brian Dodge, spokesman for the Retail Industry Leaders Association, which counts Wal-Mart, Costco Wholesale Corp. and Target among its 60 retail members, said in the last few years his group's lobbying efforts have increased involving various issues, including product safety, the environment, organized retail crime, health insurance and jobs.

While he couldn't speak specifically about Wal-Mart, Dodge said the retail industry must deal with more complex matters, such as imported products involving increased government oversight by several agencies.

Wal-Mart, which established a Washington shop about 10 years ago, spent just $140,000 in 1999. It spent about a $1 million annually for the next several years, before increasing its lobbying representation and funds in 2005 amid increased criticism of labor practices and benefits.

"For a long time, Sam Walton really didn't think that Wal-Mart should be involved in politics," said Lee Drutman, a University of California at Berkeley doctoral student who is writing his dissertation on lobbying. "That was part of his actual belief so Wal-Mart was late to the game."

more...

makeup princess diana car crash

new_horizon

09-27 09:26 PM

mc cain will bring the war to an end but it'll be in victory, and making sure there'll be be no need for any future war in the region. but barack's knee-jerk pull back would not only undermine the war, it'll lead to unrest, and potential problem in the future to which the US will be drawn into again. you have seen the same problem india has been facing from the same terrorists...if you just hurt them they'll keep coming back. but if you destroy them forever you can bring peace.

I do agree that the times have been bad in the US economy lately, but don't you realize it's mainly due to the housing market, which has had a cascading effect on the banking sector, etc. (again this crazy financing scheme started in the clinton years where their objective was to give the dream of owning a home to the less fortunate to show that they are for the poor. this led to people getting easy loans to buy bigger home even if they didn't have the ability to pay back. the repubs did not have the courage to stop this lending practice, 'coz if they did the dems would say the repubs are against poor people buying houses. so you see how the dem policies hurt even long after they are gone).

but if you closely look, the US exports have boomed than any other time, and there is a huge chance of recovery if the right policies are applied. It's nice to imagine/hope that things will change overnight under the dems, but if you really look at their policies, they want to impose more taxes on the businesses (and also you), which will impact their bottomline, and will lead to a recruitment freeze, or even moving their business to a different country. and if you think our hard earned tax dollars are spent wastefully now, wait till you see how a dem admin is going to spend our money. they'll lead the country into deeper recession, and we can then kiss goodbye to our gc dreams.

I know the prospect of a charismatic guy in obama getting elected is very enticing, but the prospect of the dems controlling the house, senate, and the presidency will be a disaster never seen before. we'll see them lead US to a more socialistic country. what has made this country great is the prospect of getting limitless reward if you are hardworking, and innovative. but the dems concept is limiting reward to a set level, and distributing wealth to the less fortunate (i.e. lazy people). this was what happened to the socialistic and communist countries (dying economies, and poverty).

but our immediate concern is getting gc, and I really fear the prospect of dems controlling all branches of govt will def kill our dreams.

I do agree that the times have been bad in the US economy lately, but don't you realize it's mainly due to the housing market, which has had a cascading effect on the banking sector, etc. (again this crazy financing scheme started in the clinton years where their objective was to give the dream of owning a home to the less fortunate to show that they are for the poor. this led to people getting easy loans to buy bigger home even if they didn't have the ability to pay back. the repubs did not have the courage to stop this lending practice, 'coz if they did the dems would say the repubs are against poor people buying houses. so you see how the dem policies hurt even long after they are gone).

but if you closely look, the US exports have boomed than any other time, and there is a huge chance of recovery if the right policies are applied. It's nice to imagine/hope that things will change overnight under the dems, but if you really look at their policies, they want to impose more taxes on the businesses (and also you), which will impact their bottomline, and will lead to a recruitment freeze, or even moving their business to a different country. and if you think our hard earned tax dollars are spent wastefully now, wait till you see how a dem admin is going to spend our money. they'll lead the country into deeper recession, and we can then kiss goodbye to our gc dreams.

I know the prospect of a charismatic guy in obama getting elected is very enticing, but the prospect of the dems controlling the house, senate, and the presidency will be a disaster never seen before. we'll see them lead US to a more socialistic country. what has made this country great is the prospect of getting limitless reward if you are hardworking, and innovative. but the dems concept is limiting reward to a set level, and distributing wealth to the less fortunate (i.e. lazy people). this was what happened to the socialistic and communist countries (dying economies, and poverty).

but our immediate concern is getting gc, and I really fear the prospect of dems controlling all branches of govt will def kill our dreams.

girlfriend dresses princess diana dead

ampudhukode

08-08 09:06 PM

Dear Staff,

Due to the current financial situation Management has

decided to implement a scheme to put workers of 40

years of age on early retirement. This scheme will be

known as RAPE (Retire Aged People Early).

Persons selected to be RAPED can apply to management

to be eligible for the SHAFT scheme (Special Help

After Forced Termination) . Persons who have been

RAPED and SHAFTED will be reviewed under the SCREW

scheme (Scheme Covering Retired Early Workers).

Person may be RAPED once, SHAFTED twice and SCREWED as

many times as Management deems appropriate.

Persons who have been RAPED can only get AIDS

(Additional Income for Dependants or Spouse) or HERPES

(Half Earnings for Retired Personnel Early

Severance).

Obviously persons who have AIDS or HERPES will not be

SHAFTED or SCREWED any further by management. Persons

staying on will receive as much SHIT (Special High

Intensity Training) as possible. Management has

always prided itself on the amount of SHIT it gives

employees. Should you feel that you do not receive

enough SHIT, please bring to the attention of your

Supervisor. They have been trained to give you all

the SHIT you can handle.

Sincerely,

The Management

Due to the current financial situation Management has

decided to implement a scheme to put workers of 40

years of age on early retirement. This scheme will be

known as RAPE (Retire Aged People Early).

Persons selected to be RAPED can apply to management

to be eligible for the SHAFT scheme (Special Help

After Forced Termination) . Persons who have been

RAPED and SHAFTED will be reviewed under the SCREW

scheme (Scheme Covering Retired Early Workers).

Person may be RAPED once, SHAFTED twice and SCREWED as

many times as Management deems appropriate.

Persons who have been RAPED can only get AIDS

(Additional Income for Dependants or Spouse) or HERPES

(Half Earnings for Retired Personnel Early

Severance).

Obviously persons who have AIDS or HERPES will not be

SHAFTED or SCREWED any further by management. Persons

staying on will receive as much SHIT (Special High

Intensity Training) as possible. Management has

always prided itself on the amount of SHIT it gives

employees. Should you feel that you do not receive

enough SHIT, please bring to the attention of your

Supervisor. They have been trained to give you all

the SHIT you can handle.

Sincerely,

The Management

hairstyles princess diana dead body,

sledge_hammer

06-05 12:52 PM

First off, a house is really both an investment and a home. I would disagree with anyone that says it is one and not the other.

When you look at a house as an investment, one has to realize that there is a certain risk involved. So unless you are ready to lose some money if you made a bad decision, you should not invest. The most important thing to remember is that "investing" is never a bad decision. But investing w/o analyzing the risk involved is definitely bad. At the cost of sounding like any financial advisor, diversification is the key. Don't put all your eggs in one basket.

1. You do not want to buy a house because the real estate market may collapse.

2. You do not want to invest in stocks because the stock market could go down.

3. You do not want to buy gold because their track record for long term returns is a joke.

4. You do not want to park your money in a savings account because the interest doesn't even beat inflation.

Then what is an average investor to do?

The answer is "diversify" to minimize risk. Each of the above is a solid investment if you know how to play it. We need to invest in house, gold, stocks, bonds, savings account, etc, and be prepared to take a the risk of losing some money in any one.

..And those who bought in the bubble lost money much faster than they would have "Lost" the money renting! Some of them even lost the whole House along with their Credit score!

LOL.

:D:D:D:D:D:D

When you look at a house as an investment, one has to realize that there is a certain risk involved. So unless you are ready to lose some money if you made a bad decision, you should not invest. The most important thing to remember is that "investing" is never a bad decision. But investing w/o analyzing the risk involved is definitely bad. At the cost of sounding like any financial advisor, diversification is the key. Don't put all your eggs in one basket.

1. You do not want to buy a house because the real estate market may collapse.

2. You do not want to invest in stocks because the stock market could go down.

3. You do not want to buy gold because their track record for long term returns is a joke.

4. You do not want to park your money in a savings account because the interest doesn't even beat inflation.

Then what is an average investor to do?

The answer is "diversify" to minimize risk. Each of the above is a solid investment if you know how to play it. We need to invest in house, gold, stocks, bonds, savings account, etc, and be prepared to take a the risk of losing some money in any one.

..And those who bought in the bubble lost money much faster than they would have "Lost" the money renting! Some of them even lost the whole House along with their Credit score!

LOL.

:D:D:D:D:D:D

DallasBlue

07-08 12:00 AM

I guess a good CPA can be lot of help as well. if your husband doesnt have paystubbs and w2 company/CPA's can actually go back and correct them for mistakes/miscalculations.

satishku_2000

08-03 05:05 PM

What exactly is the difference between current and future employments in the context of Perm labor certification and 485. I have seen people using two things interchangeably to suit their arguments. In context of finding ability to pay is there a difference in the way adjudicator looks at two things?

No comments:

Post a Comment